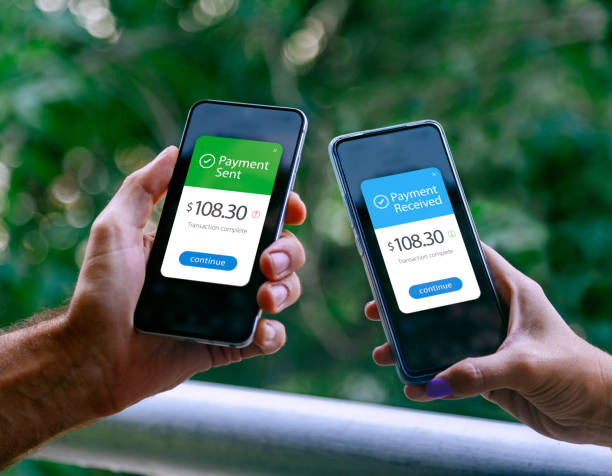

Digital banking and e-wallets are reshaping how Malaysians manage their money. From street markets to shopping malls, contactless payment has become the new normal. To fully enjoy this convenience, it’s essential to register e-wallet bank account Malaysia. With HLB Connect, linking your e-wallet to your bank account is not only fast—it’s secure, smart, and seamless.

Why Register an E-Wallet Bank Account in Malaysia?

When you link your bank account to an e-wallet, you unlock a new level of convenience. Instead of topping up manually each time, you can fund your e-wallet instantly and monitor transactions in real time.

Here are the key benefits:

- Faster Transactions: Skip the manual top-up process and make payments on the go.

- Secure Payments: Enjoy added security through encrypted transfers and fraud monitoring.

- Financial Control: Track your e-wallet usage and bank transactions in one platform.

Registering your e-wallet-linked account ensures you never miss a beat while going cashless.

Benefits of Using HLB Connect for E-Wallet Registration

HLB Connect makes it incredibly simple to register an e-wallet bank account Malaysia. As one of the most user-friendly digital banking platforms, HLB Connect provides full compatibility with major Malaysian e-wallets, including Touch ’n Go eWallet, Boost, and GrabPay.

Why choose HLB Connect?

- Seamless Integration: Link e-wallets directly through the app in just a few steps.

- Top-Notch Security: Biometric login, transaction alerts, and real-time fraud detection keep your funds safe.

- Accessible Anytime: Manage your e-wallets through the HLB Connect app or website—anytime, anywhere.

Whether you’re shopping online, transferring funds, or dining out, HLB Connect gives you full control at your fingertips.

Step-by-Step: How to Register E-Wallet Bank Account Malaysia via HLB Connect

Getting started is easy. Just follow these steps:

- Log in to your HLB Connect app or access it via the web portal.

- Navigate to “Pay & Transact” and select “E-Wallet Linking.”

- Choose your e-wallet provider (e.g., Touch ‘n Go, Boost, GrabPay).

- Authorise the linking process using your banking credentials.

- Set spending limits and alerts to stay on top of your expenses.

Once linked, you can instantly transfer funds or automate top-ups—no extra steps required.

Additional Features That Simplify Digital Banking

HLB Connect offers more than just e-wallet linking. The platform is packed with digital tools to make money management easy:

- QR Pay & DuitNow: Scan to pay at stores and send money with just a phone number.

- Bill Payments & Mobile Reloads: Settle utility bills or top up mobile credit without switching apps.

- Spending Insights: Get automatic spending summaries and alerts for better budgeting.

This all-in-one banking solution helps you stay ahead financially in a fast-paced digital world.

Why More Malaysians Are Choosing HLB Connect

HLB Connect appeals to a wide range of users—from students and gig workers to professionals and SMEs. It offers a smooth onboarding process, real-time support, and the reliability of a trusted Malaysian bank.

By choosing HLB Connect, you get access to a full ecosystem that supports your digital lifestyle, making it easier to manage daily expenses, track your budget, and stay secure.

Conclusion

If you’re ready to go cashless, now is the time to register e-wallet bank account Malaysia with HLB Connect. It’s fast, secure, and gives you total control over your digital finances.

Sign up with HLB Connect today and experience smarter banking, all in one app.